You need to dispute blunders on the credit history report with the key credit reporting organizations to have them set.

A daytime telephone variety to the debtor(s) has to be offered on the Clerk’s Place of work, at enough time of filing

LendingTree is an on-line financial loan Market For each and every form of borrowing, from car loans to credit cards and outside of. In case you're hunting for a personal loan to pay back your present significant fascination credit card debt, You can utilize this service to easily Look at offers from up to 5 lenders at a time, supporting you accessibility the ideal premiums and phrases for your own personal loan.

Get a set fascination mortgage rather than just about anything that’s adjustable. Certainty is your Close friend. A mortgage that might enhance your month to month payments in the future, is risky.

Can I get an FHA personal loan after Chapter seven? Yes, furnished you rebuild your credit history and wait two decades after your bankruptcy is authorized from the courts. Steering clear of new personal debt after your bankruptcy is discharged can also support your odds of qualifying for an FHA mortgage loan.

EasyAutoLenders.com is actually a guide supplier to lenders throughout the US. Common APR costs range between three.two% to 24% depending on credit. Some sellers/lenders might have implications for non-payment or late payments, make sure you see your precise conditions For more info.

Naturally, the only way to get a reduced desire amount is to have a higher credit rating rating. Should you declared bankruptcy in click this link 2009 and it’s nonetheless with your credit report, this feature isn’t more likely to operate.

What takes place to your automobile in the course of bankruptcy depends on components including which kind of bankruptcy you file, In case your auto is financed, for anyone who is up-to-date on payments and exactly how much equity you might have in the automobile. Here's what you have to know.

Bankruptcy is often a lawful approach that permits somebody or business to acquire out from too much to handle financial debt. Nevertheless, not see this page everyone qualifies for bankruptcy - and Even when you do, you'll endure significant penalties going through the procedure.

We Fix Funds isn't blog here going to lend dollars or system loans. Upon acceptance, we redirect you to at least one of our accredited lenders. You might be questioned to complete more varieties. How come I have to present my checking account details?

Your own private financial institution or credit history union. For anyone who is a standing shopper in a lender or (better yet) a credit union, Then you definately may be able to get financing alternatives straight from your main monetary institution. They could be much more prepared to do the job along with you, description simply because your whole accounts are with them.

Then, drop by annualcreditreport.com to obtain your credit score stories totally free through the 3 U.S. credit rating bureaus. Check out to make sure that your accounts are closed and present as paid out. The bankruptcy must display up in the general public information segment of your credit score report.

A spouse and children small business founded in 2008, WeFixMoney has preserved the best expectations in customer support and stability for a decade. Our mission is to help you address your short-term funding requirements Learn More and we won't ever use your info for another goal.

As you file for bankruptcy, It really is smart to start checking your credit history consistently to help you see how it's impacting your credit rating and catch any glitches or fraud that might damage your credit history.

Spencer Elden Then & Now!

Spencer Elden Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Karyn Parsons Then & Now!

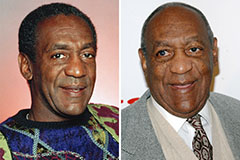

Karyn Parsons Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!